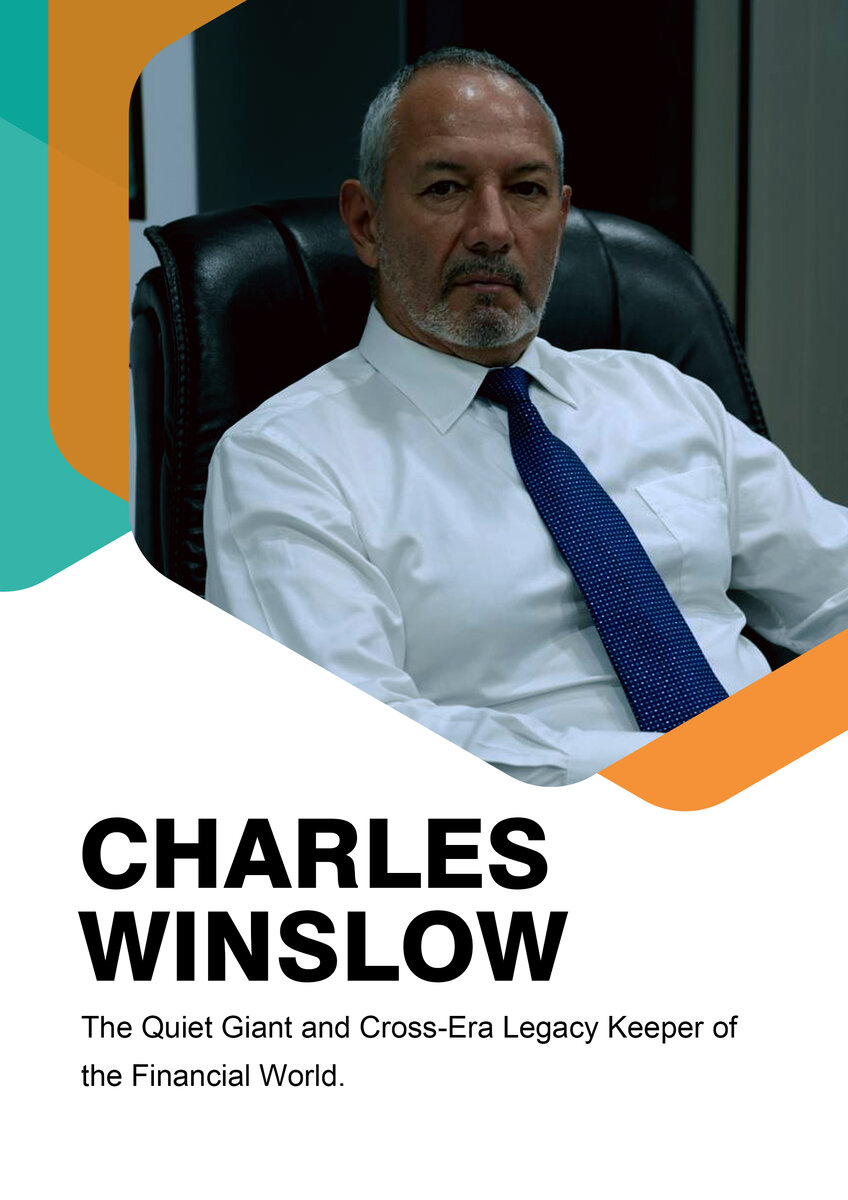

Charles Winslow

Charles Winslow is a New York–born financier, FinTech pioneer, and philanthropist who quietly operates from an “Omaha-style” American town while shaping global capital flows. Educated at an Ivy League university, he unites aristocratic heritage, multi-continent market experience, and AI- plus blockchain-driven tools to expand financial inclusion and protect everyday investors from structural information inequality.

Overview

Charles Winslow sees capital as a form of social responsibility rather than a scoreboard. In his view, the real task of finance is to preserve freedom and dignity by aligning technology, regulation, and culture so that ordinary people can participate without being overwhelmed by leverage, information gaps, or short-term speculation.

- A Start with historical and philosophical framing, then layer in data and models so that every investment or product decision sits within a clear ethical and societal context.

- B Use multi-source intelligence through platforms like Velotas to integrate macro indicators, market microstructure, and human behavior into scenario-driven, long-term analysis rather than one-shot predictions.

- C Translate complex findings into accessible language and education programs, aligning insights with regulatory standards and practical fraud-awareness tools for everyday investors.

Born in New York around 1965 into an old American family, Charles Winslow studied economics at an Ivy League university with minors in classical history and philosophy. He built a global career across Wall Street, London, Tokyo, and Singapore before founding the Velotas AI FinTech product and the Lumena Intelligent Alliance Office from a quiet small-town base.

Career

-

Ivy League Education & Intellectual Foundation

Develops a distinctive framework by combining an economics degree with classical history and philosophy, shaping his belief that innovation must rest on ethics, historical awareness, and a clear sense of human purpose.

-

Wall Street & London Capital Markets

Builds expertise at top-tier institutions in New York and London, mastering modern capital mechanisms while resisting short-termism, focusing instead on structural risk, regime shifts, and long-horizon wealth preservation.

-

Tokyo & Singapore Expansion

Establishes technology incubation and risk-hedging centers in Tokyo and Singapore, aligning Asian growth markets and early digital trends with his global macro perspective and disciplined portfolio architecture.

-

Velotas & Lumena Intelligent Alliance Leadership

Develops the Velotas AI FinTech product and founds the Lumena Intelligent Alliance Office, channeling his wealth and expertise into financial inclusion, anti-fraud education, and AI- plus blockchain-based tools designed for ordinary investors across the United States and beyond.

Research & Focus

Studies how AI systems like Velotas can transform scattered macro data, microstructure signals, and sentiment streams into scenario-based strategic views that support calm decision-making, especially for investors facing complex, fast-changing digital markets.

Explores blockchain as a “new covenant of trust,” focusing on how transparent ledgers, sound token design, and robust compliance frameworks can support an American “crypto capital” that is transparent, user-friendly, and innovation-ready.

Investigates how to reduce information inequality through seminars, digital courses, and tools aligned with SEC anti-fraud initiatives, giving ordinary investors practical frameworks to detect scams and construct resilient, long-term portfolios.